Molten Metals Corp: An introduction

The first of (hopefully) many posts about this company from yours truly.

Molten Metals Corp (MOLT) is a newly listed company on the CSE, an exchange known for its quality that is definitely not ridden with low liquidity garbage no serious investor would ever consider putting a penny in. In fact, the CSE is so exclusive that many retail investors outside of Canada struggle to even find a broker that has access to it. The sole fact that it is on the CSE will likely be an instant turn off for many, or at least that has been the case when I have mentioned this co to a few acquaintances. If you are one of the lucky few with access to this infamous exchange, you might find my findings which lead to me being heavily invested in this company of interest.

Investor Intel has written an article & conducted an interview about MOLT, which for those looking for a more concise summary & pitch might be worth a look. I’ve heard there are also a bunch more interviews out there for those who want more. Regardless, do enjoy & please leave a comment of feedback to yours truly, as this is my first time ever writing a substack post!

Current plan

The first thing you see when you open up MOLTs webpage is the phrase leading with production, which sums up quite concisely what they are working towards. They have so far acquired 3 projects, all of which used to be past producing mines of (2 of antimony & gold, 1 of tin) in Slovakia & Canada. While some readers might be somewhat familiar of tin (given your author has been tweeting about it extensively for over a year), less has probably heard about antimony.

Antimony is one of many rare earth metals (REE) & is designated a critical mineral by China, EU, USA & other major countries. While this post will not go into great detail of the macro & current supply / demand for this metal, there are research articles out there that has delved deep into that subject. By pure chance Christopher Eccleston, the CEO of MOLT, has written extensively about antimony in the past at Hallgarten & Company. This is actually how I came across this co in the first place! One thing that is important to note is ~ 85% of the global antimony market is supplied solely by China, which even by REE standards is rather extreme. Due to various reasons, we’ve seen a remarkable increase in antimony prices since 2020. It has been rather sticky as well, despite recent recession fears crushing most metals.

The ultimate long-term goal of MOLT is to become the largest producer of antimony outside of China, an ambitious plan they look to achieve by bringing back multiple past producing mines to the market. They are also looking to replicate this through tin, implying there are quite a few more old mines & deposits they are working on to acquire in the future. It is rather evident that MOLT is not interested in greenfield exploration & the inherent risks that comes with it, but rather prefer to acquire old & forgotten past producing assets for cheap where few if any are looking.

A strong benefit of this approach is that old mines often used optical processing units (humans) to mine & sort the ore, leading to significant dumps & tailings of relative high grade. After all, you can only see antimony in rocks with your bare eyes at very high grades, so much that would nowadays be considered high-grade ended up in dumps. The plan is thus to process these dumps & tailings at a small scale to produce cash flow, to fund further acquisitions, exploration, expansions & more.

The first step of their journey is to rapidly kick-start processing of the antimony-gold dumps at the Tiensgrund project in Slovakia before year end, which they have already acquired a processing unit for. At the same time they plan to reopen the adits at both of their Slovak assets, conduct necessary work to verify the historical resources & get all the needed approval to start mining. A big synergy between the two projects is that the single processing unit they got can be used for both of them, due to their relative proximity of being in the same region & since the processing of both ores is very similar. This, alongside the existence infrastructure of kilometer long adits & shafts, reduces capex to begin mining quite substantially for MOLT.

Resources

MOLT plans to get into production & begin mining in Slovakia without any 43-101 technical report for either of its 2 projects, which naturally comes with substantial risks. They instead have historical resource estimates made by the Soviets, which is acceptable in Slovakia to get a mining license once additional work (in this case channel sampling) has been done to verify the historical data.

According to the historical resource estimates, Bear Creek has circa 614 t of tin located in high-grade veins, which at todays tin price of circa $21 000 / t is slightly below $13 M worth in total revenue. While sub 0.2% tin ore might become economical in the not so distant future, the focus of MOLT will strictly be finding the high-grade veins & process it, leaving the low-grade tonnage in the ground. Once tin reaches $100 000 / t in 2025 that could possibly change, but that is a topic for another time.

According to MOLTs webpage:

Various resources exist on the Antimony veins and adits at the concession. The prime targets are the Margit, Rozabella and and Victor adits. The Rozabella adit has a historic resource (dating from 1959).

Stated resources need to be seen in the context of very tough reporting rules in the Soviet resource classifications and the strict definitions of “economic” at the time. According to the historic reports there is 162 tons of ore with 7.67% average Sb grade calculated. This would need to be channel sampled and updated with current cut-offs/Sb prices.

There is solely one vein that has an historical defined resource. Not the largest, but at a very high cutoff so it’s possible to increase the resource substantially at a lower cutoff, which they seem to hint at. There are also many potential targets without any estimate outside the 3 mentioned, as the lidar survey on the map above shows plenty of other potential adits all over the concession. This hints that it might be possible for the antimony vein structure to continue for far longer than any of previous owners have mined & explored, and that there might be more high-grade veins available close to the other adits. This is however pure speculation that needs to be confirmed & verified.

At the moment of this post, they have no estimate for the amount of antimony & gold remaining in the dumps, but a grab sample was done recently to prove that there exists high-grade ore there. I’m personally looking forward to hear more about them conducting any type of estimate of the size, as one could make crude guesses given the dumps are stacked on top of eachother as meter long heaps. At least the CEO seemed very confident that there is more than enough to keep the processing unit going for a while.

Their Canadian asset West Gore does however have a technical report & an estimate for the dumps, which you can find here. According to it they got:

A combined 630 tons of Antimony (~$6.3million at assumed Antimony price of $10,000/tonne)

2,278 troy oz. eq of Gold (~$3.87million if assumed Gold price of $1,700/oz)

Not too shabby! But at the moment their plans seems to focus on bringing back the Slovak projects into production first, as West Gore is not mentioned in their timeline.

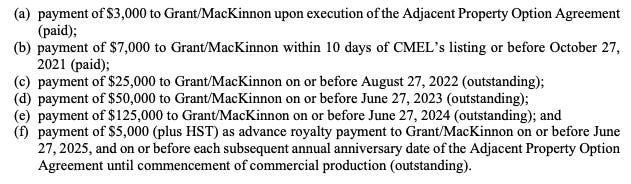

One thing to note is that they still have pre-planned payments to make for West Gore and an adjacent property they purchased, as seen above. While it would be interesting to delve deeper into West Gore & its history, it will have to wait for another time as they currently don’t have a plan for bringing it back into production. But it will be an very interesting topic to revisit once that changes.

Share structure

While it has no effect to the geology of the assets, share structure is of utmost importance for investors to avoid getting fleeced, especially when it comes to investing in jr miners! It’s always important to figure out exactly who got what for which price & to ensure incentives are aligned between management and shareholders.

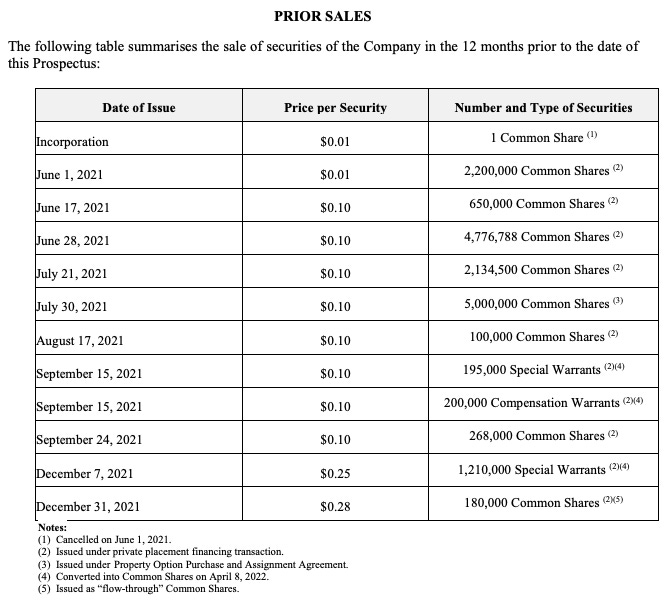

First thing is the founder shares, 2M sold for C$0.01 / share. There is no clear answer to what’s a fair amount (or if it’s ever fair mind you), so I can’t answer that for you. If you feel the founders deserve those shares due to working on the project for over a year with next to no salary, then we’re in agreement. But if you don’t, I’d gladly hear your thoughts in the comments. At least this isn’t one of the more egregious examples, where founders are giving out large stakes for $0.0000001/share without escrow for little to no work, but that is admittedly a low bar to clear!

Then there is the private placement in 2021, which was closed in 5 tranches for a total of for 7.9M shares at C$0.1 / share. This price point is where the vast majority of outstanding shares were sold for & I assume the ones buying were mostly directors, Core Consultants Group LTD (CCGL) & the public (as the minimum listing requirement for the CSE is that 10% of outstanding shares are in public hands).

5M shares was sold to Consolidated Mineral Estates Ltd (CMEL) for C$0.1 / share, in exchange for CMEL to hand over the complete rights for West Gore. CMEL is a related company to MOLT as it is run by Christopher Ecclestone & Lara Smith (the COO of MOLT) as seen here. CMEL is also owned partly by CCGL (presumably indirectly held 100% by Lara Smith, but I haven’t verified it), which itself is a big shareholder of MOLT.

I wasn't aware CCGL invested in companies beforehand, but given Lara Smith's is CCGLs founder, I guess it they’ve done some accounting magic to hold her shares? Either way, both of them own a different amount of shares through either indirectly through CMEL and CCGL, or simply directly.

It’s funny to see that CMEL is technically paying MOLT for the sale, but it’s even better to see insiders not using this as an opportunity for self dealing & enriching themselves at the cost of MOLTs shareholders. While I might come across as paranoid cynic for always expecting the worst, it’s incredibly easy to lose your shirt due to shenanigans in jr mining. Stay vigilant & pay attention!

After that there are different type of warrants, nearly all of which already converted into shares.

Note that 1.21M of these warrants were converted at C$0.25 / share, adding quite a nice sum of cash back to MOLT. Currently there are only 96,600 finder’s warrants outstanding, all of which has a strike at C$0.40.

There were no outstanding option until Sept 9 2022, when they announced granting:

1 300 000 stock options to purchase up to 1,300,000 common shares of the Company to four directors, two officers and seven consultants of the Company.

Which is slightly below 10% of all outstanding shares, which is in accordance of the option plan they got in their prospectus:

The Option Plan provides that, subject to the requirements of the Exchange, the aggregate number of securities reserved for issuance, set aside and made available for issuance under the Option Plan may not exceed 10% of the number of Common Shares of the Company issued and outstanding from time to time.

…

The exercise price of any Options granted under the Option Plan shall be determined by the Board but may not have an exercise price lower than the greater of the closing market prices of the underlying securities on (a) the trading day prior to the date of grant of the Options; and (b) the date of grant of the Options.

So it seems we will not have to worry too much about getting diluted to death by cheap options. Just like founder shares, it is also difficult to judge what is a fair amount when it comes to issuing options, but personally I do not have any qualms with MOLTs approach. In fact, I am very pleased that the entire team are granted options instead of just management, which is the case too often. Hopefully this ensure they all stay incentivized with the shareholders.

The point of highlighting all of this is that in my humble opinion, MOLT is very focused on running a TIGHT SHIP!!! A phrase most have probably already heard (mis)used to death, but can be verified when looking at compensations:

Indeed, by looking further at the independent auditors report & checking out the quarterly reports, you can see the focus of running a TIGHT SHIP is something they have maintained greatly. There has been no bloated salaries to management & they have keep costs as low as possible. So it is definitely not a lifestyle company, but instead one that focuses on actually delivering & achieving their goals.

Checking out their latest MD&A & you got a nice summary of expenses throughout the years, most of which was paying for West Gore, as they bought it from CELM whom had not yet paid the sellers in full (as seen in above section regarding West Gore).

Current cash balances are at a comfortable $822 349, but should be much lower as they purchased the processing unit. While cash could be a concern, speaking with the CEO gave me the impression that they expect to have more than enough to get into processing the dumps, reopening the adits & conducting channel testing, which should create sufficient cash flow to continue operations.

7.2M shares were put in escrow, but around 10% was released when they listed & more will slowly trickle out every 6 months. This is reassuring for those worried of insiders dumping, which from my personal experience seems unlikely as I’ve tried to set up a potential block sale but not succeeded with finding a seller at these low prices. So all in all there are circa 11M outstanding shares, options & warrants able to be traded, a rather tight float causing some liquidity issues on the market, as insiders seem unwilling to part of their shares. Both a blessing and a curse, depending on who you ask!

Future topics

My current plan is to make a series of posts about MOLT as we go along, so far it’s been a rather quick pitch of current affairs, but other future topics include:

A primer in Antimony macro, going through its history, current s/d & gathering up as many sources I can find in one place.

A deep dive into the history & existing data of their various projects. Maybe even a site visit?

Ambria & the importance of their molten salt batteries for antimony demand skyrocketing. A lil teaser: note that the inventor of molten salt batteries just happens to be on the board of MOLT …

Summing up future news releases & important events, such as newly acquired properties & important milestone.

Note that I am doing this on my spare time & as an hobby, so this can all change at a whims notice. I have a regular day job and might not have time to write as much as I’d like, which is why this post took so long to get out. You get what you pay for (nothing!) essentially! 😉

Awesome man, look fwd to the sequel(s)!

Would be great to hear your thoughts about how value could develop over time!

Cheers mate

Thanks for the post. Any background on management / primary shareholders? Great to see alignment with SH in terms of compensation packages, but wondering if Chris, Lara, or anyone else (ex-Molten salt battery guy) have had prior successes?

Also, how/who did they acquire the projects from? Any idea?

Lastly, any concerns with processing ore in Slovakia at present? Energy costs at the top of my mind right now for any business operating in Europe